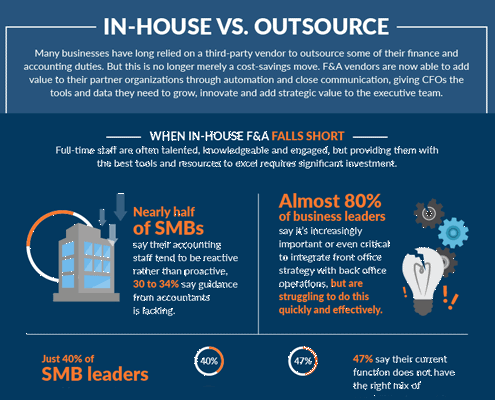

In today’s fast-paced business world, companies are constantly evaluating their options when it comes to managing their accounting needs. One of the key decisions they must make is whether to outsource their accounting function or handle it in-house. Both options have their own set of pros and cons, and it is important for businesses to carefully consider these factors before making a decision.

Outsourcing Accounting

Outsourcing accounting involves hiring a third-party service provider to handle all or part of the company’s accounting needs. This can include tasks such as bookkeeping, payroll, tax preparation, and financial reporting. There are several benefits to outsourcing accounting, including:

Cost Savings

Outsourcing accounting can be a cost-effective solution for companies, especially smaller businesses that may not have the resources to hire a full-time accountant. By outsourcing these tasks, companies can save money on salaries, benefits, and overhead costs.

Expertise

When companies outsource their accounting function, they are able to tap into the expertise of professionals who specialize in accounting and financial services. This can help ensure that the company’s financial records are accurate and up-to-date, and that all regulatory requirements are being met.

Focus on Core Business Activities

By outsourcing accounting, companies can free up valuable time and resources to focus on their core business activities. This can lead to increased productivity and profitability, as employees are able to concentrate on tasks that are directly related to growing the business.

In-house Accounting

On the other hand, some companies choose to handle their accounting function in-house. This can involve hiring a full-time accountant or establishing an accounting department within the company. There are also some advantages to keeping accounting functions in-house, including:

Control

By keeping accounting in-house, companies have more control over the accounting process and can ensure that their financial data is being handled securely and confidentially. This can be particularly important for companies that deal with sensitive financial information.

Customization

In-house accounting allows companies to tailor their accounting processes to their specific needs and requirements. This can lead to a more personalized and efficient accounting system that better serves the company’s unique financial situation.

Quick Response Time

Having an in-house accounting team can lead to quicker response times when issues arise or important financial decisions need to be made. This can be especially important in fast-paced industries where time is of the essence.

Conclusion

In conclusion, the decision to outsource or keep accounting in-house is a critical one that can have a significant impact on a company’s success. Both options have their own set of pros and cons, and it is important for businesses to carefully weigh these factors before making a decision. Ultimately, the best choice will depend on the company’s specific needs, resources, and long-term goals. Whether outsourcing or in-house accounting is chosen, it is crucial for companies to prioritize accurate and timely financial reporting to ensure the health and growth of their business.