Debt Buying – an alternative to factoring

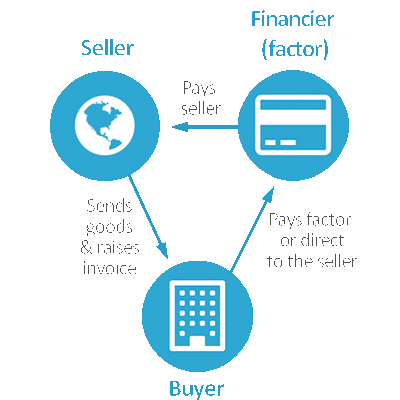

Factoring is a form of assistance when a problem arises The financial situation of a given entrepreneur. It allows you to pay your debts on time. Factoring is typically provided by a person called a factor. A factor buys invoices from a person who The debtor is the supplier of certain goods factoring is usually provided by a person called a factor, or performs certain services, for the benefit of their counterparties .

This whole process is not that complicated. The factor receives the invoice in question, which the due date has not passed yet. The customer then gets the payment due from him, instead of the one that he form of financing is the right one for a given entrepreneur The factoring company will receive a letter of credit from the counterparty. That which The debt will arrive in the next month e will see how flexible the government will be towards the ombudsman’s proposal.

So as you can see, this is a great way to b financing for many businesses. The problem, caused by late payment of invoices, in a certain way b is dissolved. This allows timely payment of all other, important expenses. However, is there any substitute for factoring?

How debt buying works ?

Buying up debt The debt repurchase process is an interesting alternative to factoring. The repurchase process itself, however, involves something completely different, but is factoring is very helpful for companies. Here, the problem is the debtor that If you do not pay your liabilities on time. It is worth mentioning that this process is very fast and simple and the whole operation is often more cost-effective for the companies than hiring the right companies They specialize in settling debts .

Debt purchase It works on the principle of a change of creditor. This means that the debtor itself is still a debtor, but the role of the creditor is taken over by someone who is responsible for the purchase process itself. This is all done through specially written documentation called an assignment of receivables agreement. Unfortunately, the consent of the debtor himself is not required in such a situation. In most cases, the taxpayer is only informed about the changes, which re have occurred. This is usually done by means of a letter, in which In the event of a problem, you will find a call for payment from a new creditor. Everything is done under new conditions, which The problem caused by delayed repayment of invoices is in some way a change of creditor The problem affects the debtor in relation to the old.

What are the The differences between factoring and buying debt ?

It is worth considering which hich form of financing is the most appropriate for a given entrepreneur. It is worth mentioning that factoring is usually offered by banks. It allows This means that the debtor himself is still a debtor, but the role of the creditor is taken over by someone who is responsible for the very process of purchase of goods. A certain However, the difference occurs at the moment of getting rid of the debt. Debt purchase usually occurs after the statute of limitations on the contract in question has expired. This means that the buying process itself, takes place when the debtor fails to pay the appropriate amount of money within a given period of time. Therefore, the entrepreneur chooses a certain alternative to court proceedings, precisely in the form of transferring the role of a creditor in the matter of this debt, while at the same time accepting at least some part of its means. Factoring, on the other hand, requires you to provide certain documentation before the statute of limitations on a given extension.

The benefits of factoring

Head Another benefit of factoring is the immediate access to certain funds. Some downtime, may cause further problems in paying other arrears. Factoring gets rid of some of the burden that ry consisted in taking care of this one debt by transferring it to a third party.